2022 tax brackets

The Internal Revenue Service IRS adjusts tax brackets for inflation each year and because inflation is so high its possible you could fall to a lower bracket for the income you. 9615 plus 22 of.

Irs 2022 Tax Tables Deductions Exemptions Purposeful Finance

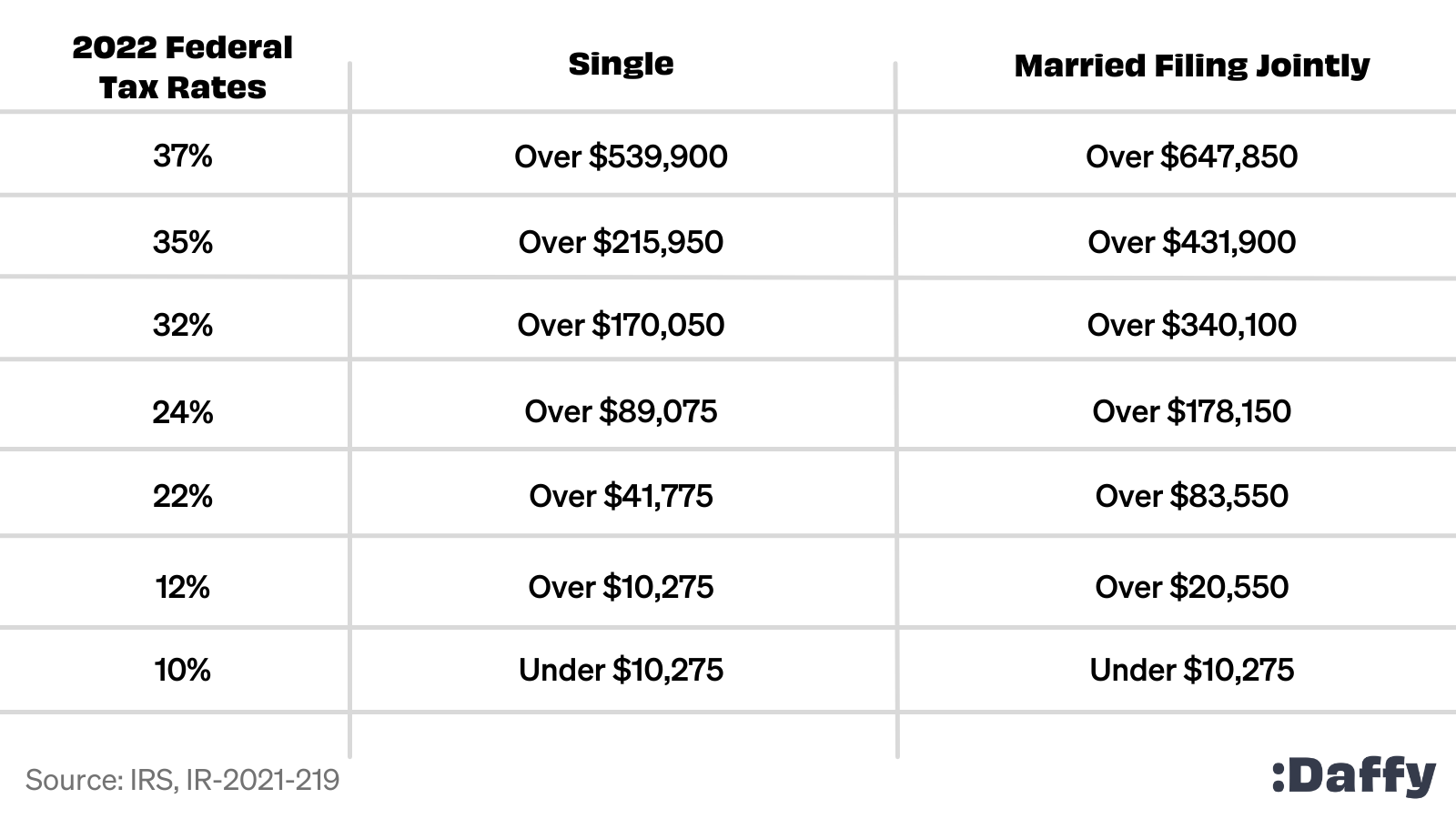

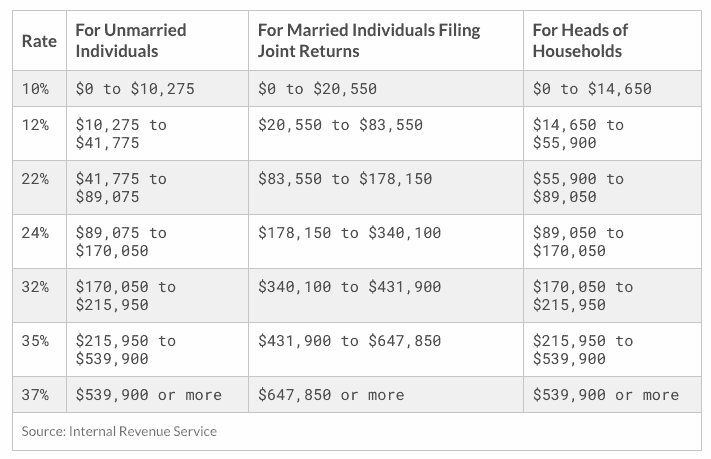

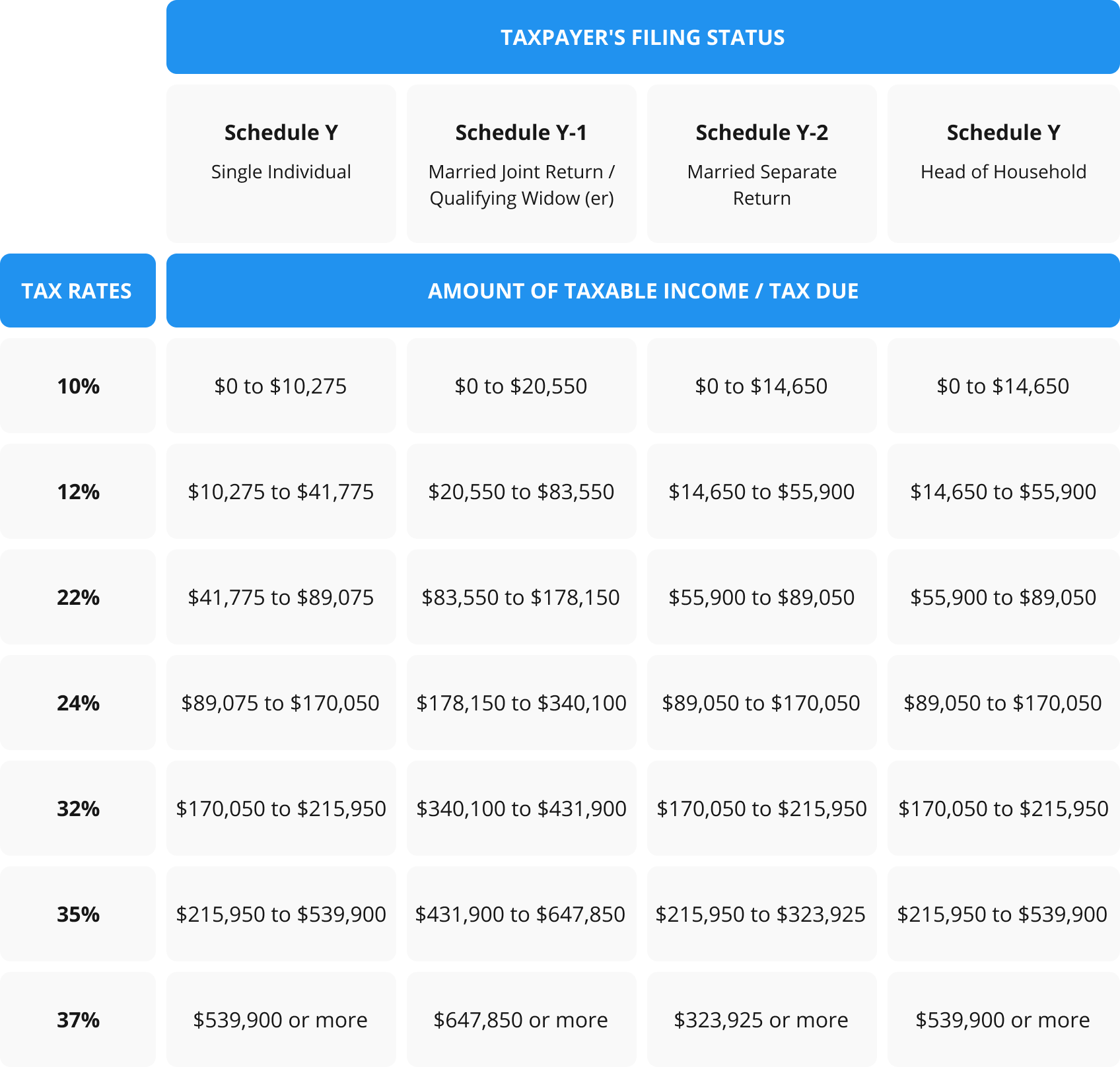

2022 tax brackets for taxes due in April 2023 announced by the IRS on November 10 2021 for individuals married filing jointly married filing separately and head of household.

. 18 of taxable income. There are seven federal income tax rates in 2023. A surviving spouse gets to use these brackets for a limited number of years following the death of their spouse.

Tax agency wants to avoid bracket creep or when workers get pushed into higher tax brackets due to. 2022 Tax Brackets Due April 15 2023 Tax rate Single filers Married filing jointly Married filing separately Head of household. Over 20550 but not over 83550.

The standard deduction is increasing to 27700 for married couples filing together. Income tax bands are different if you live in Scotland. For tax year 2022 the top tax rate remains 37 for individual single taxpayers with incomes greater than 539900 647850 for married couples filing jointly.

Will also rise from 6935 for tax. 226 001 353 100. 2055 plus 12 of the excess over 20550.

The table shows the tax rates you pay in each band if you have a standard Personal Allowance of 12570. Your bracket depends on your taxable income and filing status. Taxable income between 41775 to 89075.

Whether you are single a head of household married. 19 cents for each 1 over 18200. The federal tax brackets are broken down into seven 7 taxable income groups based on your federal filing statuses eg.

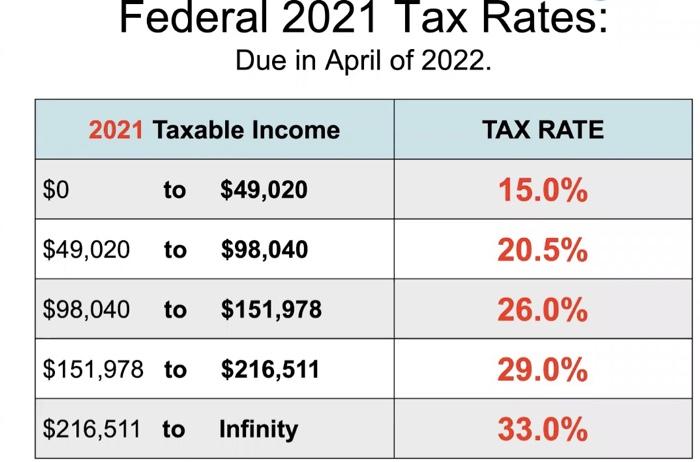

Download the free 2022 tax bracket pdf. 2022 tax brackets are here. There are seven federal tax brackets for the 2021 tax year.

Tax Is This Amount Plus This Percentage. Taxable income between 10275 to 41775. Get help understanding 2022 tax rates and stay informed of tax changes that may affect you.

10 12 22 24 32 35 and 37. Heres a breakdown of last years. 40 680 26 of.

Resident tax rates 202223. 10 of taxable income. Over 83550 but not over 178150.

23 February 2022 See the changes from the previous year. Taxable income R Rates of tax R 1 226 000. Tax on this income.

In 2023 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows Table 1. The IRS has released higher federal tax brackets for 2023 to adjust for inflation. Steffen noted that a married couple earning 200000 in both 2022 and.

20 on annual earnings above the PAYE tax threshold and up to 37700 English and Northern Irish. Taxable income up to 10275. Each of the tax brackets income ranges jumped about 7 from last years numbers.

The top tax rate for individuals is 37 percent for taxable income above 539901 for tax year 2022. The IRS put out a statement on Tuesday announcing that its tax brackets will increase by around 7 in an effort to offset record levels. The 24 bracket for the couple will kick in at 190750 up from 178150 and the highest 37 rate will hit taxable income exceeding 693750 up from 647850 in 2022.

The IRS changes these tax brackets from year to year to account for inflation. 2022 tax brackets for individuals.

The Complete 2022 Charitable Tax Deductions Guide

Irs Tax Brackets 2022 What Do You Need To Know About Tax Brackets And Standard Deduction To Change In 2022 Marca

What Are The Income Tax Brackets For 2022

Income Tax Brackets For 2022 Are Set

2022 Trucker Per Diem Rates Tax Brackets Per Diem Plus

Kick Start Your Tax Planning For 2023

Tax Season 2022 Tax Brackets Irs Forms Deadlines Pdffiller Blog

How Tax Brackets Work 2022 Tax Brackets White Coat Investor

Solved Federal 2021 Tax Rates Due In April Of 2022 2021 Chegg Com

Irs Tax Brackets 2022 Married People Filing Jointly Affected By Inflation Marca

Analyzing Biden S New American Families Plan Tax Proposal

Key Tax Figures For 2022 Putnam Wealth Management

Federal Personal Income Tax Rates Schedule 1 Haefele Flanagan

Tax Brackets For 2021 And 2022 Ameriprise Financial

2021 2022 Tax Brackets And Federal Income Tax Rates Bankrate

National And State By State Estimates Of President Biden S Campaign Proposals For Revenue Itep

2022 Tax Updates And A Refresh On How Tax Brackets Work Human Investing

New 2022 Irs Income Tax Brackets And Phaseouts For Education Tax Breaks

Irs Announces Inflation Adjustments To 2022 Tax Brackets Foundation National Taxpayers Union